The first digital banking solutions delivered by Efigence came into existence over ten years ago, along with more and more growth online and mobile accessibility. Since then, digital banking has gone through several substantial revolutions and changes. Today, digital banking platforms offer not just storing and transferring of money but also a whole range of value-added services and features.

To some extent, they’ve become centers of our everyday life and work. We at Efigence are much more advanced, too. What did we learn from these years of working for the greatest financial brands? And how can we use this knowledge to improve digital banking platforms that are now mushrooming?

Although the financial sector is, in general, quite developed and innovative, especially in Europe, still, for many customers, innovativeness is not the first term that comes to mind when thinking about financial institutions. However, our world is dynamically changing, and it’s being shaped by digital transformation. Today everything, including banking, has to be fully digitised, quick and convenient. It’s actually mandatory. That’s what modern banks strive to achieve – digitised, on-demand services. And the last ten years of the development of digital banking show that the market extraordinarily appreciates this approach.

At Efigence, we’ve been shaping the digital banking scene for already quite a long time. We work for the biggest banking groups as an advisor and a provider of innovative technologies and design. We’ve gathered a list of ten valuable lessons you can draw from modern digital banking platforms. We hope it will inspire you to look at your work in new ways.

Lesson 1: It’s all about the mindset

If you want to become fully digitised, you have to change the way of thinking about your product. Granted, it takes some out-of-the-box thinking, especially in a world governed by statistics, indicators, diagrams and laws.

A good example is mBank – the very first Polish fully-online bank. A dozen or so years ago, we helped them become a leader in innovative banking solutions. The management of mBank decided that they needed to move their employees to a new building to facilitate creative thinking. Through this, we had the opportunity to see how important it was to combine creativity with the bank’s business goals. Everything you do has to be purposeful and well-thought-out. This way, both sides inspired each other to think out of the box and align ideas with the business.

The results were more than satisfactory. Back in 2014, over 30% of all mobile banking app users in Poland were mBank customers. Significantly, at that time, mBank didn’t have a 30% market share, and that shows the scale of its success. Together, we certainly gave Polish mobile banking a boost.

Read also: Banking in pandemic times

Lesson 2: UX is king!

Undoubtedly, user experience is what matters in everything you do digital-wise. UX should be a central part of your marketing, sales and business strategy. After all, it’s all about the user, right?

Today, banks have a limited possibility of competing with their core services; you can’t lower credit interest endlessly. You have to find a competitive advantage elsewhere – in the way you treat your customers. This revolves around customer service, communication and the use of additional channels and tools. Among them, mobile apps are likely the most important ones.

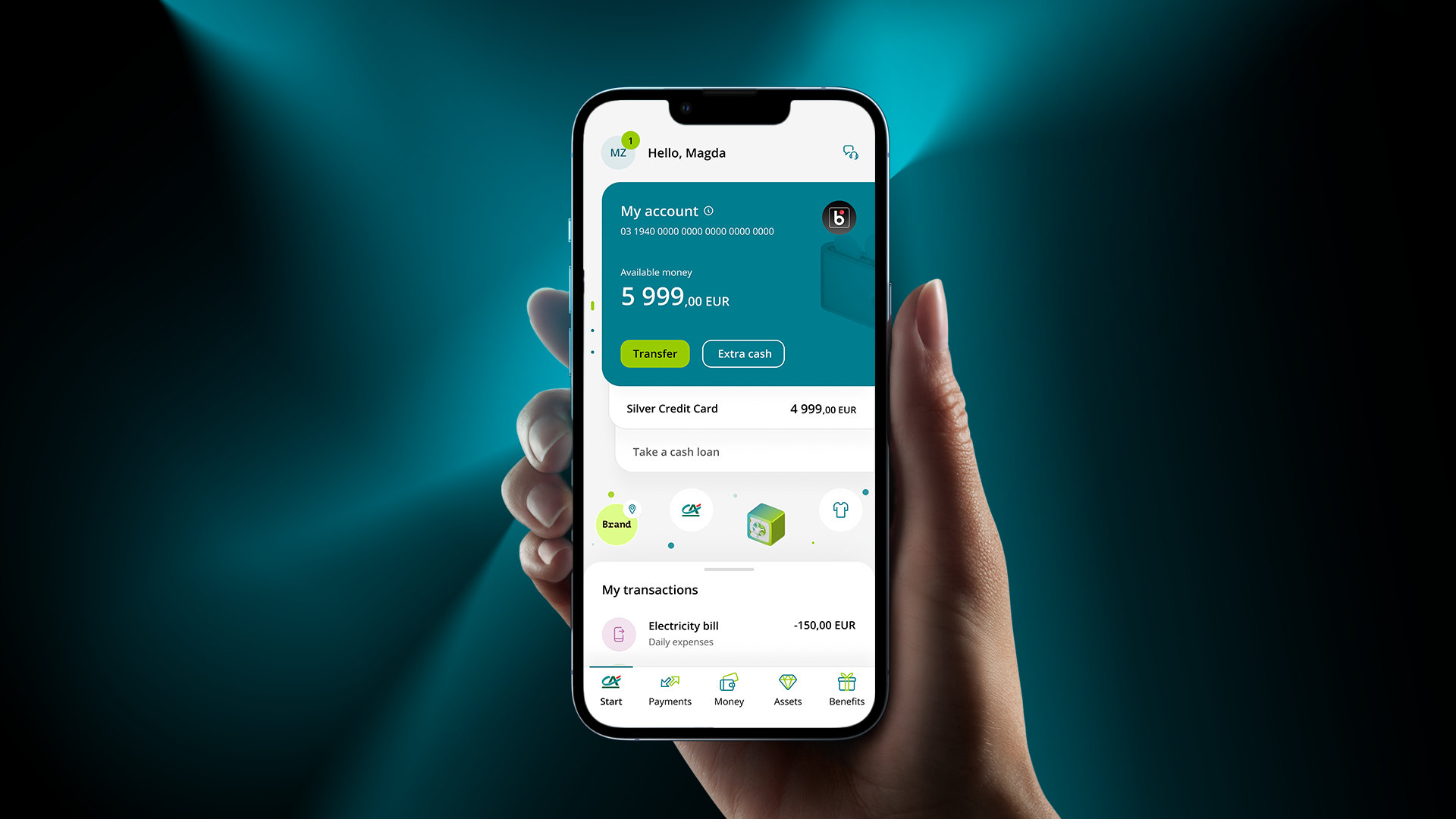

Here, we’d like to draw your attention to our recent project. Together with Credit Agricole Bank Polska, we’ve made a brand-new mobile app that takes mobile banking to a whole new level. This new app makes daily mobile banking a pleasant experience and presents the bank’s products and services in an innovative way. This is what our client has said about the project:

“The new Credit Agricole Bank Polska application focuses as much as possible on the customers’ needs, building a lasting relationship with them and supporting them in their daily tasks. On the way to achieving this effect, one of the key elements was the appropriate design of the tool.”

Read more about this project: A new, higher level of banking: an innovative application from Credit Agricole Bank Polska

Lesson 3: Start with the concept

For over 10 years, we’ve been starting each new project with a concept. That’s one of the keys to our success. Sometimes, conceptualisation takes one week, and sometimes it takes two months, but this stage is crucial.

The concept is the project’s foundation, a base for communication and work for the entire team. A well-prepared concept means you can finish working on the final interface and functionality of the platform faster. However, in order to be successful, your idea must be a reflection of a solid and well-researched vision that’s backed up by a full understanding of the technology behind it.

With a refined concept, we can get the approval of everyone involved in the project without the risk that, at some point along the way, we’ll have to scrap our work and start all over again. That’s what makes this approach better than endless iterations, where things can go sideways at any given moment.

Additionally, there is a nice side benefit. Thanks to a concept, you can show all the stakeholders what the final product is going to be like. This way, it becomes tangible, even if you haven’t written even the first line of code yet.

Lesson 4: Opt for low-code and no-code

Every technology gradually becomes easier to master. Websites are the perfect example. Not that long ago, you couldn’t create a website without knowledge of HTML. Today, with WordPress and drag-and-drop builders, you can create an aesthetic and functional webpage without knowing the difference between <head> and <body>.

It’s the same story with digital platforms. Even Google has its own no-code platform: Google AppSheet. See how it works in this short video:

Thanks to low-code and no-code solutions, you can streamline the process of creating, updating and improving apps, websites and other digital products. As a result, you can enhance your app every week (or even more often) without the need to code everything every single time. It’s a massive simplification of work and a source of measurable money savings.

Here, Alior Bank is a good example. In their 2020-2022 business strategy, we can read that they want to “provide business employees with the possibility to create new IT solutions on their own thanks to low-code and no-code tools.”

Lesson 5: Implement secure payment options

Security is the essence of banking. Sometimes, we use the term “phygital” to describe banking services. They are present both in the digital and physical world. Every interaction with a money-related service has to be secure. And that security should be ensured not only by the payment operator but also by the bank.

Lesson 6: Algorithms and rules are useful, but they don’t have an answer for everything

In general, financial systems are based on rules and regulations. Thanks to intelligent algorithms, you can code many different variants and scenarios and automate actions for various situations (e.g., when a customer applies for a loan). Without a doubt, AI can help banks solve many problems and automate tedious tasks.

These algorithms are being used even today to:

- Prevent fraud and money laundering

- Streamline credit scoring

- Offer new personalised products and services

- Make more informed business decisions and investments

- Support customers in managing their home budgets and much more

However, rules and AI can never replace collecting and analysing real-life knowledge about the customer and their life. Banks can use these solutions as support in their work, but working directly with the customer is still immensely important.

Lesson 7: Forget about open banking

As our experience shows, open banking is a myth. Customers have no interest in cumulating all their savings in one place as it poses a threat. Besides several scenarios (e.g., when applying for a loan or a mortgage), exchanging data between various bank accounts is pointless when you can’t really manage them (only view them).

Furthermore, open banking creates a lot of challenges from the technical and legal points of view. Each bank has its own technology, and combining different accounts is a bit like trying to get Windows and MacOS to work together on one computer.

This doesn’t mean, though, that banks shouldn’t create their own ecosystems for customers. Here, Apple is a perfect example – their products and services brilliantly work together. Banks can offer a whole range of value-added services that are built-in into their systems, e.g., access to public institutions, bus tickets, paid parking systems and many more. This way, the bank becomes an umbrella for the financial front end.

Read also: Efigence in the Middle East

Lesson 8: We live in a world of microservices

Some time ago, applications and digital platforms were built as so-called monoliths. You could use the whole product or not use it at all. It was the same story with updates and modifications – it was necessary to rewrite almost the entire codebase to implement some larger changes.

Recently, a different approach has gained traction. Microservices enable web developers to build apps and platforms that have various functions and sections that work independently. So, if you have a mobile banking app and you want to implement the new payment option, you can do so without modifying the whole thing.

Such an approach comes with several benefits. For starters, updating and modifying digital banking platforms is much easier. It takes less time, is easier and, therefore, cheaper. Secondly, thanks to microservices, digital platforms are more user-friendly and versatile. And lastly, the business has now the possibility of configuring the product without the involvement of the IT department.

Fintech companies have started this revolution in the banking sector. Thanks to them, the industry now has access to thousands of ready-made components and solutions that can supplement and enhance your digital product.

We encourage you to take a look at our Aion Bank app and web banking project. Together with the client, we have created a whole library of diverse user interface components, some of which have been developed for the first time on the market.

Lesson 9: Offer value-added services

In the introduction to this post, we told you that banks are no longer places where you just store money. Today, they help customers accomplish their goals and carry out everyday tasks.

Here, Bank Pekao, with its PeoPay 4.0 mobile app is a good example. This Polish bank simplifies its customers’ lives by expanding the offer with non-banking services related to daily payments for parking, tickets, motorway travel and more.

Lesson 10: Think about ecology and sustainability

More and more consumers value green initiatives. It’s the same story in the banking sector. That’s why banking companies offer their customers virtual credit/debit cards (that are not just green but secure as well) or standard physical cards made of recycled or ecological materials (e.g., plastic waste or metal). Banks try to limit their impact on the environment and encourage customers to track and lower their carbon footprint.

For example, MasterCard has developed a carbon calculator. It enables customers to view the estimated carbon footprint of all their card purchases. And some time ago, Revolut started offering virtual single-use cards whose details refresh once the purchase is complete. It’s not just a green solution; it’s 100% secure as well.

We can expect that in the near future, every decent bank, financial institution and fintech will pursue green initiatives, both when it comes to their operations and habits and actions of their customers.

Summary: Design solutions for the digital world

What conclusions can we draw from these 10 lessons that we discussed in both parts of this article? The crucial one is this: If you want to thrive in the modern financial sector, you need to adopt a digital mindset. Design flexible solutions that are quick and effective, especially when it comes to on-demand services. Your digital banking platform should be an umbrella for the entire ecosystem, offering not just impeccable customer service and security but also a whole range of value-added services. Today, banking platforms are updated once every two weeks, and their services and mobile apps are continually developed. That’s the only recipe for success.

Moreover, banks mustn’t forget about online security, ecology (paperless service and virtual cards), CSR and local activities. This way, they can be a valuable part of their customers’ lives.

Read also: How to design inclusively and effectively: A short guide to inclusive design