Challenging the banking industry with a subscription banking mobile app for Aion Bank

Efigence helped Aion Bank execute an entirely new business model of subscription banking. Aion app brings value that was never seen before – people who want to maximize their money through savings and investments will find it most useful.

-

Services

Consulting, Research, Design, Frontend development

-

Time

12 months

-

Type

Mobile application

-

Team

6 Designers, 3 Analysts, 4 Developers

About the client

Aion, launched in Belgium in March 2020, is a European, subscription-only digital bank, offering savings and investment products to individual and business customers.

Seated in Brussels, Aion operates under a Belgian banking license, but it also offers its services to customers around Europe. The global private equity company, Warburg Pincus, is an investor. Aion introduced a new way of banking with its subscription model.

Objectives

-

Convenient offer for individuals and SMEs

Aion dedicates its services to two groups of customers – individuals and SMEs. In the individual segment, Aion is primarily concerned with wealthy customers in their thirties and forties who have high expectations about banking services and are well aware of constraints given by traditional banks.

-

Simple lightweight SME

On the other hand, the SME segment demands are pretty different. This group of customers seeks banking services with predefined integrations (e.g., tax payments or cash registers machines automatization) and complete transparency (without hidden costs and complicated pricing tables). Aion’s new way of banking resonates with those needs. Aion dedicates its offer to companies who find established banks’ competition services too complex for SMEs.

-

Top-class security

Aion aims to provide good, well-secured substitution compared to other fintech offerings available on the market. Aion offers top-class security, using the latest and best possible technologies. Saved funds are additionally protected by the Belgian Guarantee Fund (in each country where the Bank operates).

-

100% mobile

Aion Bank offers 100% mobile banking. The bank has one physical flagship branch in Brussels and besides that it functions fully online. This fact implies that its members are empowered to do all their banking needs through the mobile app or WEB interface. That forces Aion to become a highly available bank which customers always carry with them – inside their pockets. As already stated, Aion wishes to provide banking to citizens of European countries. Hence, the app needs to work within multiple legal markets realities and provide functionalities in many languages.

Strategic UX/UI

Nowadays, setting rules in the banking industry has become more challenging because of two-sided competition from fintechs and established banks. Considering this, Aion decided to focus its strategy on high-mobility customers, who are used to subscription payment models like the ones they get from Netflix or Spotify. Aion started the project with an enormous effort to assemble an entirely new banking business model from scratch. A business model where the customer experience we worked on plays a crucial role – actually the same as the products themselves.

Scattered Design & Development Process in practice – the power of iterations

We know that the first days of each project are most crucial for its success. It is also said – try fast, fail fast. That’s why our strategic UX team started almost immediately with the iterative design of the initial product concept. And, when we later figured it out – it was like hitting the bull’s-eye. These initially sketched paths of the most critical parts of the application (like the dashboard, daily banking, payments, multi-currencies, savings, investment, etc.) quickly drew the target picture of future Aion banking. It’s also worth underlining that we received excellent feedback during the first sessions of user testing. Once the product concept was ready, UI/UX designers continued work as teammates of the Scrum teams. Their efforts were continued for almost a year which allowed them to create a comprehensive, contemporary and compelling application interface. This approach helped us easily overcome the significant change of application look-and-feel introduced when Aion Bank launched its marketing communication.

The bank that challenges reality

We knew from the very beginning that we would need to challenge the way banks are currently operating. Customers don’t start banking by saying which product they need. Instead, we needed to get back to the First Principles by Brett King, in which banks used to provide three core key utility pieces: a value store, money movement and access to credit.

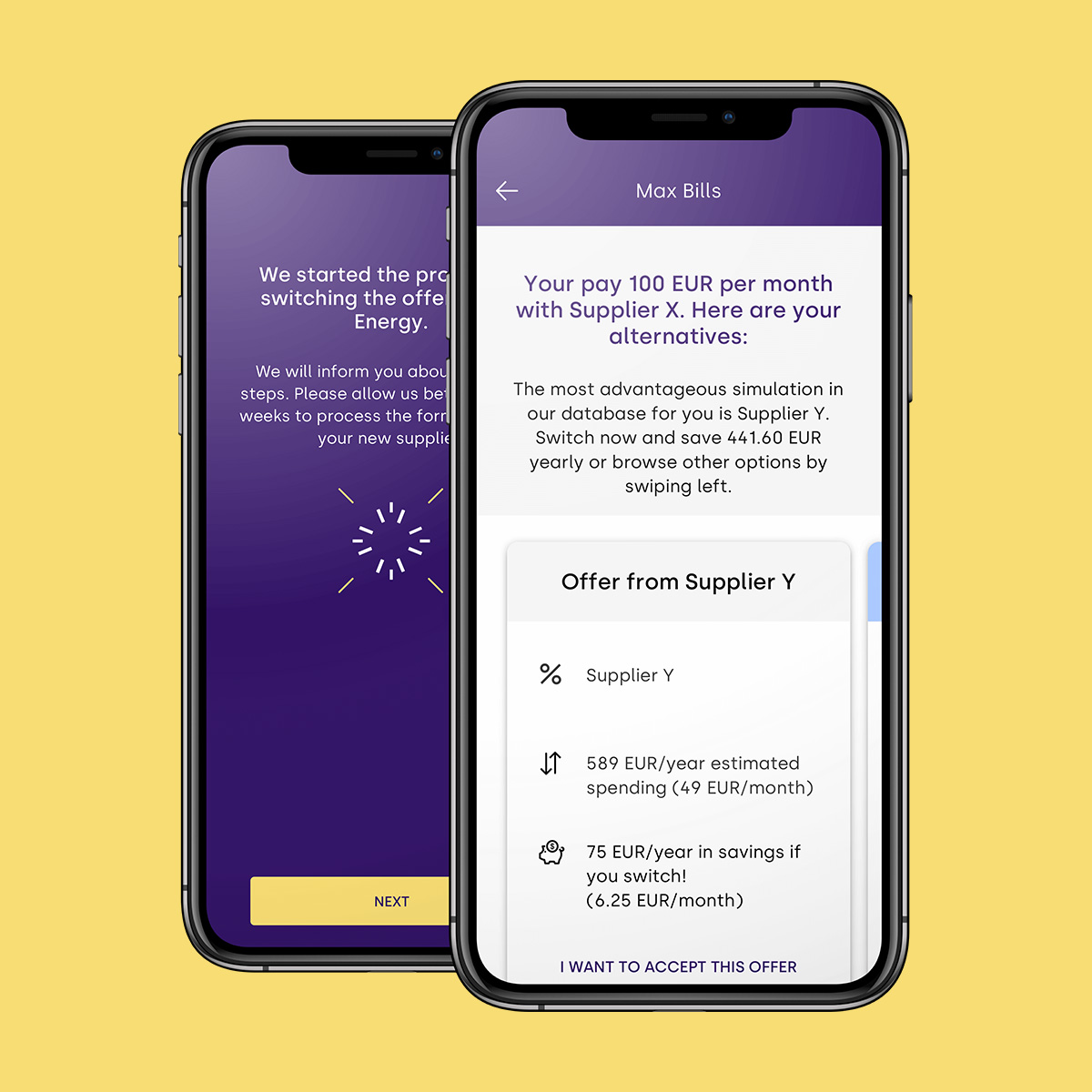

As mentioned above, the first basic customer requirement is to store value – money itself. It should be as secure as possible. Only then are customers going to start investing and accumulating savings. Here our team faced the challenge of creating an entirely new product called MoneyMax, which allows customers to obtain transparency with their money. The Aion app scans the market seeking the best options for the member.

The investment module makes it possible to invest globally in ETFs (Exchange-traded fund). The designed process guides customers in establishing the risk level and later provides them with an easy-to-choose, predefined investment portfolio. That makes the process accessible also for members who don’t possess professional finance knowledge.

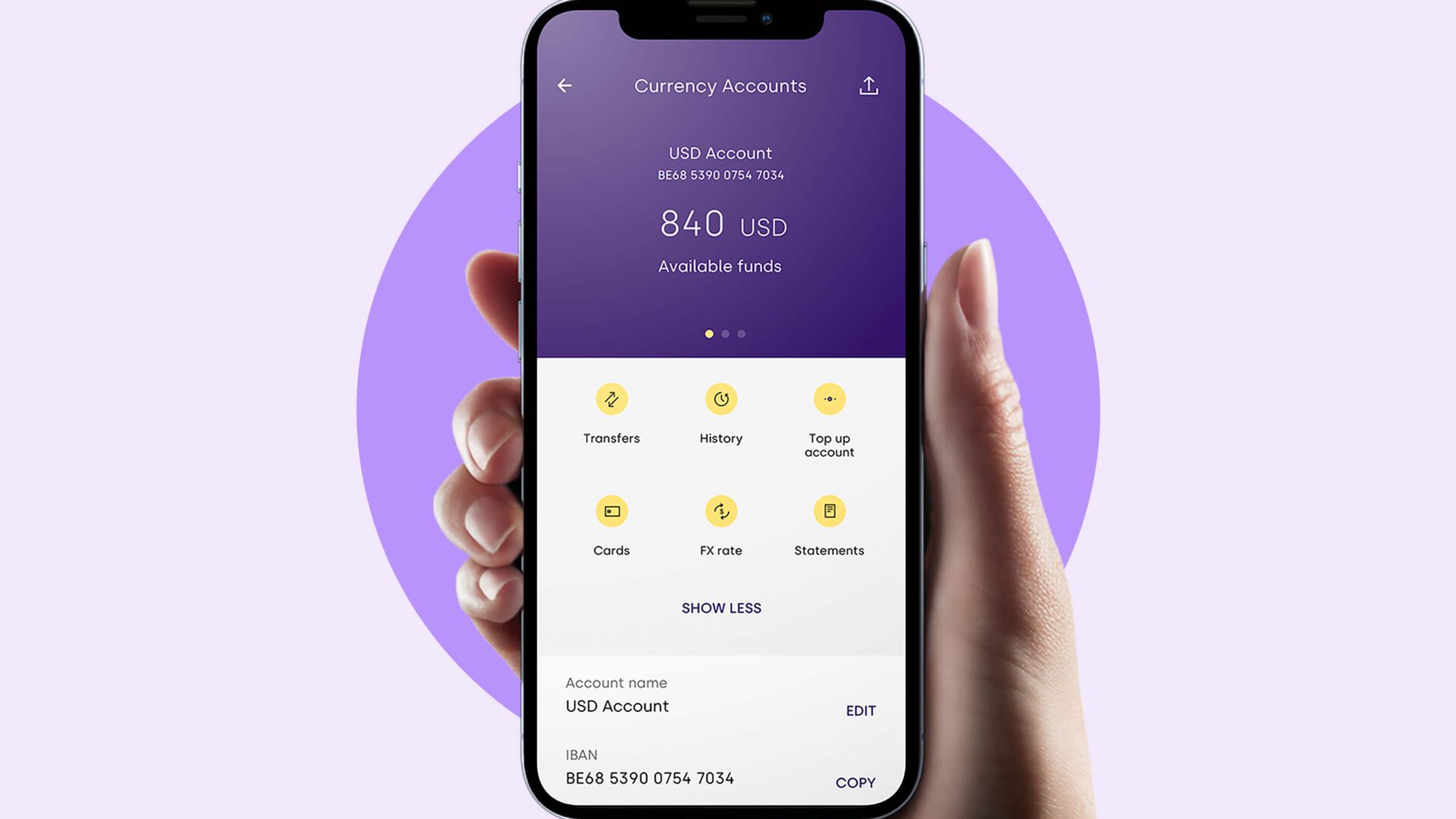

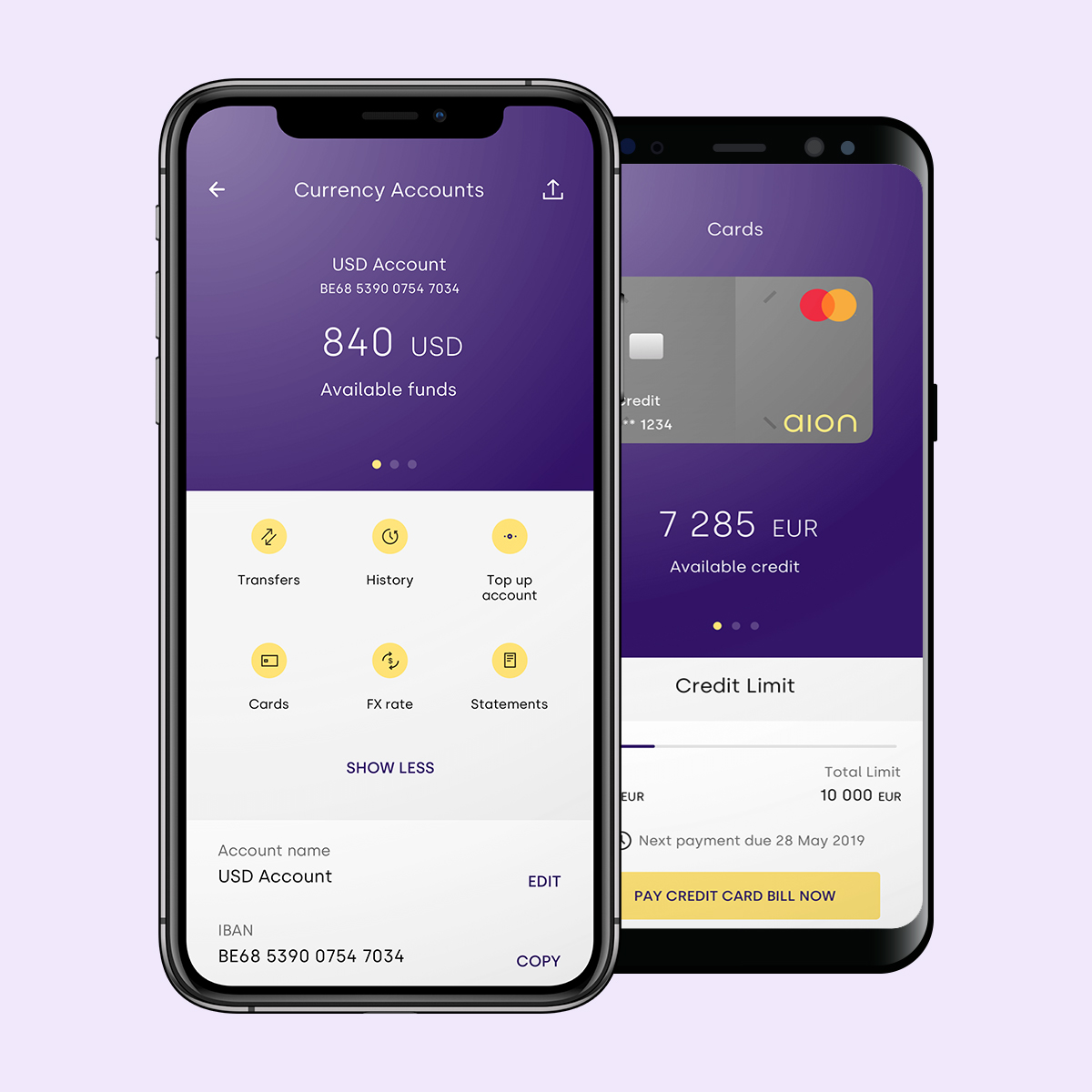

Customers expect that their money transfers will be fast and secure. Hence with this project, we took an opportunity to rethink daily banking. The result gives the end customers the opportunity to operate with multiple currencies smoothly and not see evident transfers between FIAT currencies (governments generally establish FIAT money).

Aion’s AdviseMe functionality enhances traditional banking with private banking privileges. Here our team creates a complete set of processes dedicated so the customer can obtain advice, guidance and a place to discuss any financial aspects with their financial assistant within the app.

The rethought, resketched and redesigned processes were new in the banking universe.

“A smooth combination of technological knowledge, experience in designing a digital customer journey and knowledge of the needs of a modern banking customer made it our pleasure to design digital banking for BNP Paribas. GOonline is an innovative platform making the use of bank services more simple and intuitive than ever before. It allowed us to take full advantage of our competences and experience in the area of design and frontend for banking.”

Tomasz Motyl

Chief Information Officer at Aion Bank

Frontend approach like no other

It all starts with the Aion banking application architecture. From the user’s perspective, the banking app looks like a screen set. Each of these represents a different set of functionalities. These, in the end, create areas like the dashboard, transfers, savings, investments, etc. With this project, we wanted our codebase to follow this structure. And so, it did. We placed the customer perspective as our guiding principle. Thus, Aion Bank is not just a single application – its core consists of several frontend microservices built using React Single-spa Framework. Each business context has its microservice. These so-called modules gave us easy to manage, scalable and sustainable modularity.

The cross-platform solution

Customers can easily download the Aion banking app for iOS from Apple App Store and Android via Google Play or Huawei App Gallery. Considering our guiding principle to separate business contexts, managing those two different code bases would make this process really hard to handle. On top of that, we also need to add SME customers who primarily access banking via the WEB interface. To avoid triple work (for iPhone, Android and WEB) and complicated maintenance processes, we used React Native as the cross-platform framework to deliver one comprehensive customer experience.

Shared components, no matter the device

With this assignment, our tech team faced the commonly known question of how to handle the same look and feel across multiple technologies and previously mentioned business modules. It is fair to say that the usage of React Native solved this issue. First, the tech team created the library of all user interface components. Then, multiple development teams used it. Hence, when all of the modules were embedded, creating one application user experience wasn’t compromised throughout the customer journey, no matter the device.

Executive summary

-

1

Value that was never seen before

Efigence helped Aion execute an entirely new business model of subscription banking. Thanks to our efforts the Aion app brings value that was never seen before. People who want to maximize their money through savings and investments will find it most useful.

-

2

Multinational approach

The Aion banking app is designed to operate in multiple European countries (well-perceived conservative and technology-savvy). Hence, it includes many legal realities and works well with multi-language.

-

3

Short time-to-market

To shorten the time-to-market and make maintenance easier, the applications for Android, iOS and WEB share the same component codebase written in React Native reinforced by the Single-spa framework.

To sum up:

Aion Bank is not only a revolutionary banking model but also a revolutionary user interface and unique frontend architecture.

Let’s Talk

Marcin Somla

International Sales Director