How we improved Alior Bank’s online sales by delivering perfect content targeting through a Magnolia-based portal

Services

Consulting, Research, Design, Front-end development

Time

10 months

Type

CMS-based web portal

Team

2 Designers, 4 Analysts, 8 Developers

The situation

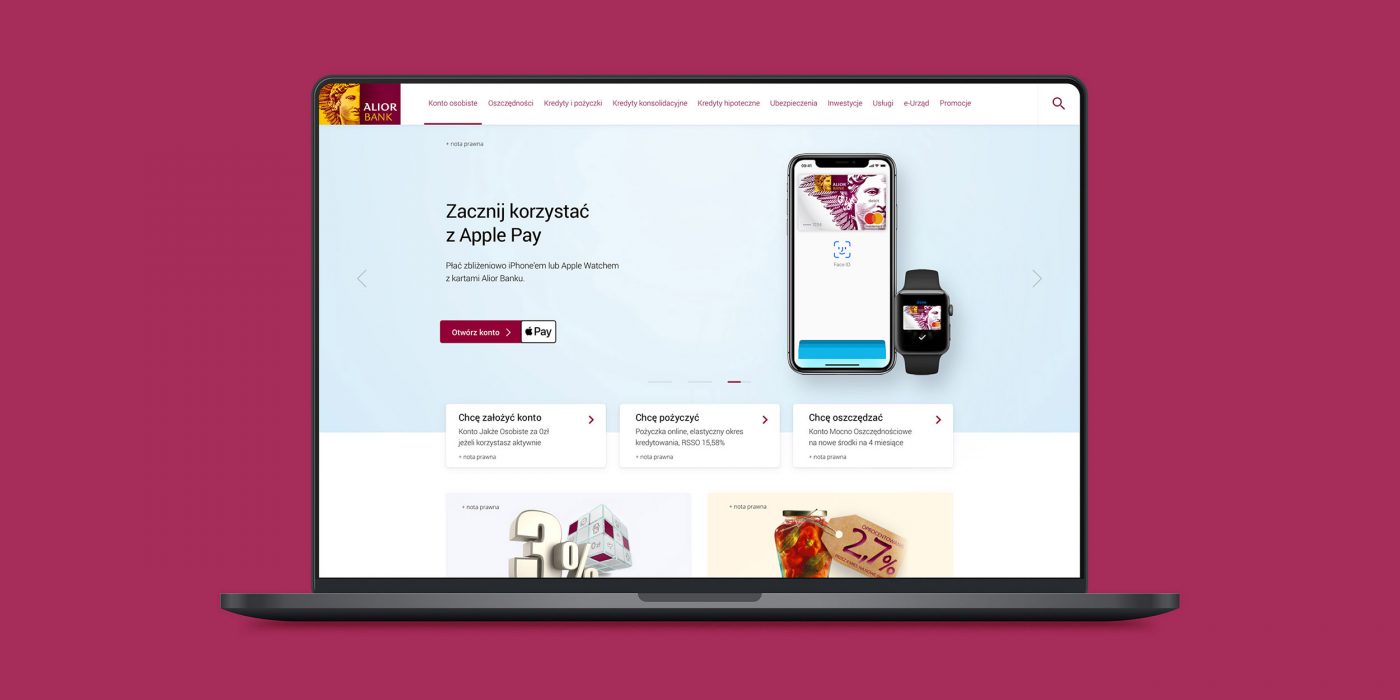

Alior Bank is a universal Polish bank addressing its services to both individuals and business customers. The company is known for its innovative products and solutions. Alior Bank wanted to liven up its page to address the needs of today’s clients, improve the site’s usability and implement search engine optimization as well as website statistic tools. Its main aim was to increase online sales both on desktop and mobile devices. The bank wanted modern online and mobile banking to bring it closer to its clients.

Challenge

Creating a modern, pleasant-to-use bank portal that becomes a perfect sales tool

Alior Bank’s previous web portal was created in 2008. It contained a lot of information but wasn’t really clear and user-friendly anymore. Also, the site didn’t display correctly on mobile devices. Alior Bank created a “lighter” version for mobiles too, unfortunately, it was already obsolete – not designed for modern smartphones. The new webpage had to support experience and sales process including the latest trends and newest technologies.

Moreover, Alior Bank’s specialists noticed that digital marketing of their products is cheaper and more effective than advertising in traditional media or in branches. The bank’s webpage was visited by about 1.7 million users per month and more than 20% of them were first-time visitors. That’s why the new website had to become easy to navigate for the clients, as well as to turn into an effective, powerful sales tool.

Our approach & solution

Smooth experience and easy-to-find services thanks to the Magnolia CMS platform

Targeted content

Furthermore, the new webpage’s templates make it SEO-friendly. The webpage became more valuable for Google robots and therefore easier to find for internet users.

Customizable form component

A new navigation tool

Perfect content targeting

Indispensable and cost-reducing integrations

“Magnolia’s ease of customization and integration possibilities enabled us to extend Magnolia with new features like an external search engine and integrate it with the bank’s systems. In the future, it will be easy to integrate Alior Bank’s website with any system that they need.”

Marek Lesiak, President & CTO at Efigence

Impact & results

Higher sales and increased web traffic

-

46% increase in the share of mobile traffic

-

42% increase in online loan sales

-

24% increase in new accounts

-

188% increase in mortgage loans sales

-

54% increase in organic search traffic

-

Increase of the time spent on the website to 5 min 30 sec

-

Decrease of the bounce rate from 30% to 10%

-

No decrease in Google search during the launch

-

Alior Bank’s products are in the top search results for terms such as “loan”, “account” and “online account”