Banks face urgent issues: combatting cyber threats and replacing outdated systems. Efigence delivers secure, scalable solutions that protect data and streamline digital platforms, ensuring efficient, modern banking services.

Challenges in Banking and Finance

-

Ensuring Secure, Seamless Transactions

The growing threat of cyber attacks requires robust security measures.

-

Protecting Customer Data

Complying with data privacy laws while safeguarding sensitive information.

-

Modernizing Outdated Systems

Upgrading legacy systems to support current and future needs.

-

Implementing Advanced Data Analytics

Using data to provide personalized financial insights and enhance decision-making.

-

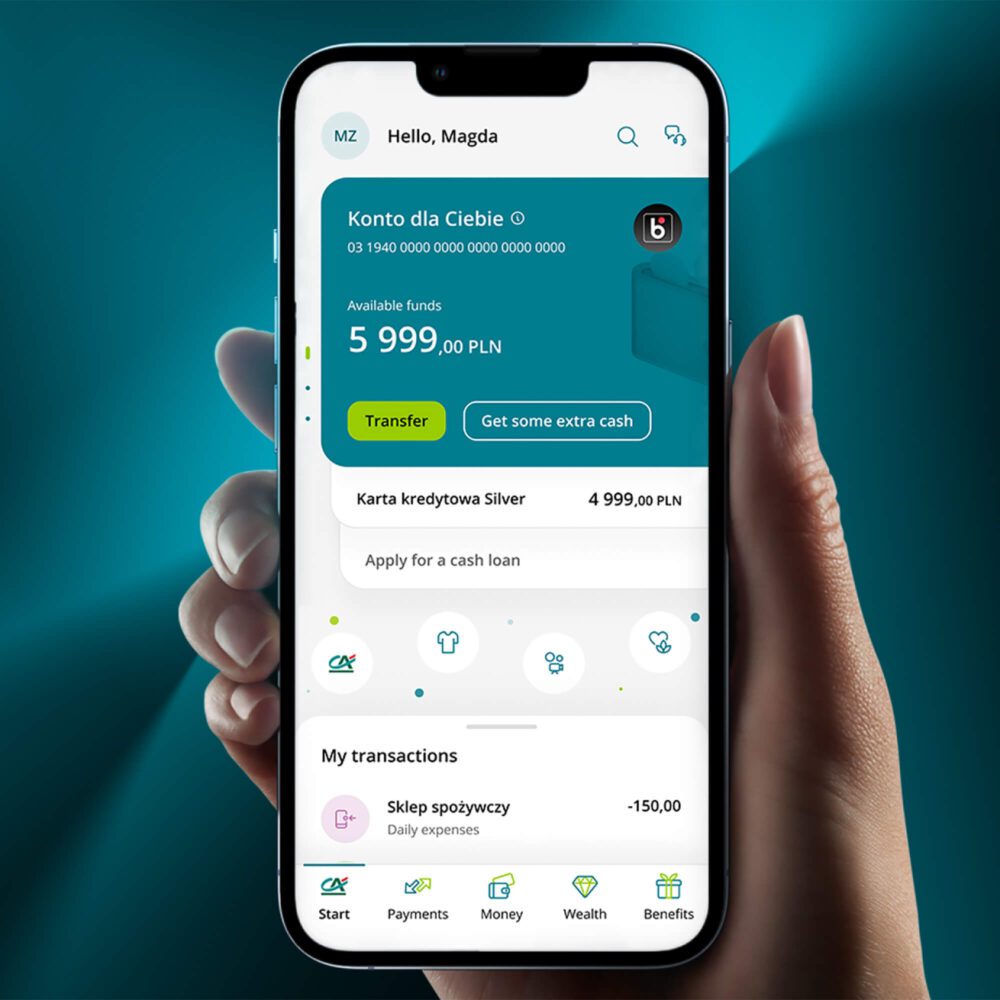

Enhancing User Experience on Digital Platforms

Delivering intuitive, user-friendly digital experiences.

-

Regulatory Compliance

Navigating complex regulations and ensuring adherence to financial standards.

Success stories

Our work helps leading brands achieve their goals.

Overcome Banking Challenges with Efigence

Whether you’re modernizing legacy systems or enhancing digital customer experiences, Efigence provides specialized solutions tailored to your bank’s unique challenges. Let’s work together to secure your systems, optimize operations, and deliver outstanding digital services.

Eryk Orłowski

Design Manager

Banking Industry Trends

Stay informed about the latest developments in digital banking. From AI integration to personalized financial wellness tools, our blog covers the essential trends that shape the future of the industry.

Proof of Our Solutions

Discover how we’ve helped businesses across various industries overcome their digital challenges and achieve success. Our clients’ experiences are a testament to the effectiveness and reliability of our solutions.

Frequently asked Questions

-

How does Efigence enhance security in digital banking?

Efigence implements advanced security measures, including encryption, multi-factor authentication, and regular security audits, to protect customer data and ensure secure transactions.

-

What is the process for modernizing legacy banking systems?

We begin with a comprehensive assessment of your current systems, followed by a strategic plan to migrate to modern, scalable solutions. Our approach ensures minimal disruption and enhanced functionality.

-

How can advanced data analytics benefit our bank?

By leveraging data analytics, we provide insights into customer behavior, improve risk management, and enable personalized services, which enhance customer satisfaction and loyalty.

-

What makes Efigence’s digital platforms user-friendly?

Our platforms are designed with intuitive interfaces and seamless navigation, ensuring an easy and engaging user experience across all digital touchpoints.

-

How does Efigence support regulatory compliance?

We integrate compliance requirements into all stages of our solutions, ensuring that your systems meet industry standards such as GDPR, PSD2, and other relevant regulations.

Keen to work with us but still have questions? We’ve gathered the most popular ones above. And if you’d like to ask us anything more specific, we’re here to help.

Let’s Talk

Rafał Ochmański

Key Account Manager