Digital Transformation 2.0

The axis of all activities of banking institutions has long been digital, an environment in which mobile now plays a key role. Digital transformation is a term that has been used for many years and has been implemented in all possible configurations, by every sector of the economy. However, what it stood for just a few years ago is completely different from what it stands for today.

We are currently dealing with digital transformation 2.0. This concept is more mature and focused on doing the best you can – rather than just doing something. The digital world, already having gained knowledge from experience and mistakes made, knows much better what challenges, problems or goals may arise in the world of digital banking, which could not be defined until recently. We are much better prepared to create successful strategies and the best possible tools in the digital ecosystem of banks.

Get ready for changes

Yes, we live in the world of VUCA again – this acronym, just like over 30 years ago, perfectly describes the reality that surrounds us now. Volatility, uncertainty, complexity and ambiguity are the hallmarks of today’s world. On the other hand, openness to the constantly changing environment and reacting to these changes is an essential element of any strategy, the inseparable element of which is readiness to modify – not only banking products but also applications and services. We should focus on the most flexible ecosystems and processes that we can change on the spot or assemble like Lego bricks. Constant updating is the norm today – not only with the competition in mind, but also in response to the needs of modern users and the environment. Without the ability to react quickly, it is difficult to keep up today, and it is even more difficult to create innovative solutions.

The upside may be that thanks to cooperation with specialized suppliers and external experts, we do not have to build various areas from scratch. Their competences and their work can be put together just like building blocks. However, if necessary, we are able to modify not just a single element, but also the arrangement of elements relative to each other.

Low-code, no-code

Low-code and no-code software is the future of banking, and banks are increasingly recognizing the benefits of using such solutions. They allow you to accelerate the development of applications, services or new products. They enable employees from outside the IT sector to access the full application lifecycle and development. Low-code and no-code platforms are equipped with a wide range of functions and can be used in many different business processes, including IT service management, project management, HR and other areas. They enable business users to create and deploy applications from predefined templates using drag and drop tools and visual editors. There are many benefits of using these types of solutions – they primarily open the door to a world of faster, cheaper and more iterative software development in the financial services sector. In terms of today’s digital transformation strategy, it is hard to even imagine not using them.

Holistic UX

UX is not only about designing experiences and digital products – it is also solving consumer problems and understanding the nuances of the business for which we create solutions, as well as acquiring knowledge about many of its areas. It is equally important to understand the different ways users interact with a given product and the challenges that can arise with it, as well as the broader business perspective. Only a multi-level view of the organization will allow the implementation of appropriate UX processes that will fit well into the entire digital transformation strategy. UX people should know how to ask the right questions in the context of a given product and its business owner, and how to research the right areas of interest to get the best possible results. Their ability to cooperate with banks and large organizations as well as good knowledge of the banking sphere are competencies that must be present in an external UX team.

Banking as a service and embedded finance

The possibilities generated by open banking have also opened new areas of cooperation for banks, for example with fintechs. Both sides can now fight together for another piece of the market pie. Situations in which fintechs engineer the highest quality services or banking products in a relatively short time, and banks gain additional financing instead of losing customers, are definitely win-win solutions.

In addition, banks today are much more than just institutions where we keep our money. With the progress of digitization, they accompany us in many everyday activities and improve processes in our financial lives. More and more often we come into contact with banking embedded in various online locations, and this certainly facilitates our financial functioning and processing. A lot of interesting developments are in the pipeline and it is certainly a topic that we must keep in mind. Developing innovative financial services in cooperation with traditional banks is an area that we cannot ignore when planning digital strategies for the coming years.

Carefully considered supplier selection

It is worth considering exactly what services we need and where it is best to look for them. If we are a large organization, let’s look for companies that have experience in working with corporations. If we need technologies that are necessarily safe, then let’s find out who specializes in them and has completed a lot of projects in these technologies. If unconventional and unique user experiences are key for us, let’s choose a company that specializes in great UX. This is very important for an organization like a bank. When selecting suppliers, it is worth assuming that experts must have skills that are different or better than those we already have access to – only these people will help bring the organization to the next, higher level.

Read also: How to design inclusively and effectively: A short guide to inclusive design

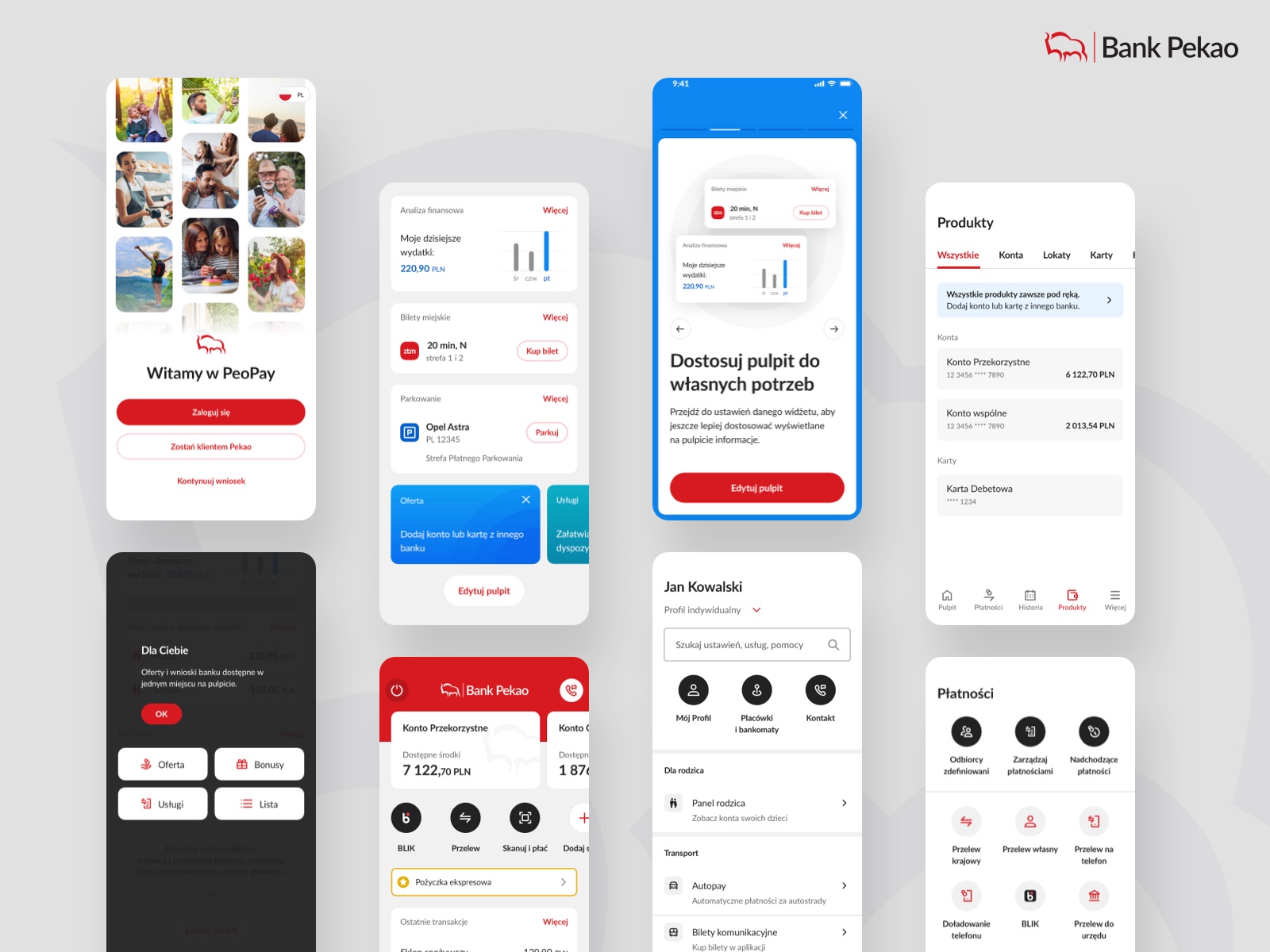

VAS as a must have for every banking application

Value Added Services become an inseparable element of every new banking application and every transaction website. Expanding the offer with non-banking services related to parking payments, tickets, highway travel, or maybe in the future even making an appointment with a doctor is something that feels ever more natural and can simplify our lives. A banking application has become a place that we visit several times a day – that’s why it’s worth making sure that you can do many more things with it than just checking the balance, making a transfer or applying for a loan. A great example here is PeoPay 4.0 from Bank Pekao S.A. – it simplifies the lives of its customers and provides non-banking services related to everyday functioning.

The PeoPay 4.0 application from Bank Pekao S.A.

Change leaders

In the process of digital transformation, so-called change leaders play a crucial role. Recruitment, both internal and external, can be very helpful when we want to gain a completely different point of view to the current one. Such a situation can be a game-changer: members of a given team tend to be strongly accustomed to familiar and fixed frameworks making it difficult to break free, so the change leader is a like breath of fresh air, proposing unusual methods, opening the team and the organization to new solutions and ultimately helping them to adapt to the new organizational model, setting goals and implementing tools to achieve them.

Vision and focus on investment

Finally, it is worth mentioning an issue that may be fairly obvious, but definitely worth reminding ourselves of. In order to be able to create a good digital transformation strategy for the bank, taking into account its dynamics in the face of the changing environment, assuming a larger budget for digital activities is one of the most important elements. Digital changes are a long-term process and it is important to give yourself an adequate margin for sudden events from the outside, actions of competitors, or the emergence of new trends or customer needs. This is, in a sense, financial vision, that in order to achieve our business goals, we must have the fuel for this. We cannot rely on a budget that will end suddenly, at a moment when we will face an important or unexpected challenge and the need to have implementation funds. Nowadays, the assumption of a financial buffer for digital activities should be obvious because what should we focus on today, if not on digital?